CASE STUDY

First Financial Bank, headquartered in Abilene, Texas, oversees approximately $14 billion in assets and employs over 1,400 staff across 83 offices. First Financial faced multiple challenges, including inefficient incident monitoring and response, disjointed cybersecurity solutions that led to time-consuming processes, and difficulties in navigating multiple systems to retrieve information during incidents. The bank sought a cyber risk management solution to streamline their ability to manage, monitor, and mitigate cyber events.

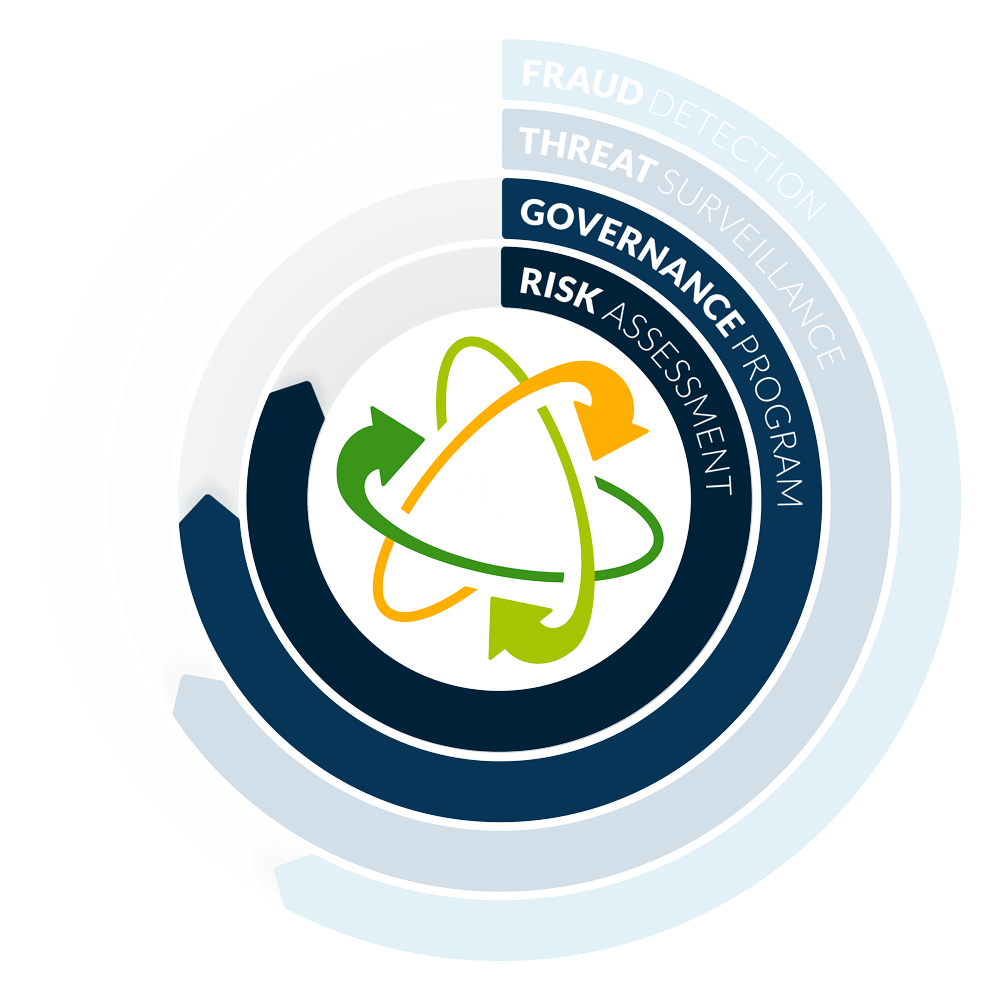

“The Risk Assessment module has facilitated a shift from qualitative to quantitative risk assessment. We now have the ability to link quantitative data to risk assessment, which we’ve never had before.”

John Lovell

Senior Security Analyst

First Financial Bank

Great Lakes Credit Union (GLCU), located in Bannockburn, Illinois, manages $1.4 billion in assets, serves 111,090 members, and employs approximately 231 people. The credit union faced challenges in managing its risk assessment and governance processes. The existing systems were disjointed and labor-intensive, making it difficult to produce meaningful reports and maintain an accurate overview of their cybersecurity posture.

Live Oak Bank, headquartered in Wilmington, North Carolina, employs around 1,015 people and manages assets exceeding $13 billion. As the bank expanded into transaction accounts, it required a real-time monitoring system capable of analyzing transaction and digital activity efficiently to prevent fraud and ensure compliance.

Our Community Credit Union, headquartered in Shelton, Washington, manages over $600 million in assets with 107 employees serving about 32,000 members. The credit union needed a comprehensive cyber risk management solution that could provide 24/7 monitoring, compliance support, and quick implementation to align with its growing strategic initiatives.